Part of the Solution

Corporate Social Responsibility (CSR) is embedded into our business model as we continue to find ways to employ strategies and processes that are sustainable. This is our commitment to be part of the solution to the issues our country continues to face.

SteelAsia at a glance

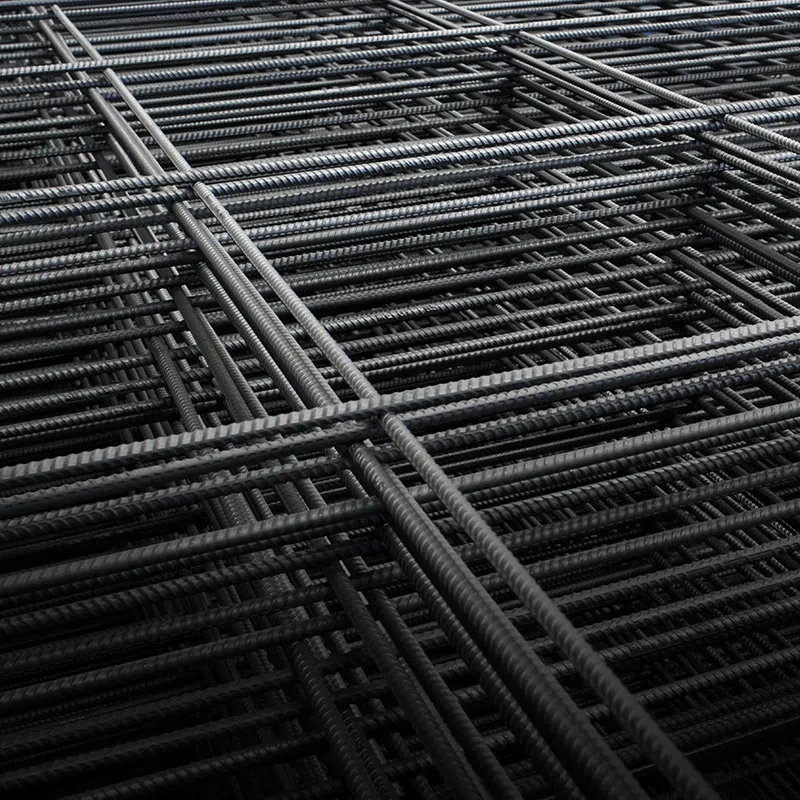

3M

Metric tons of finished steel per year

42.4B

Net revenues 2021

2,605

Employees 2023

6

Manufacturing facilities

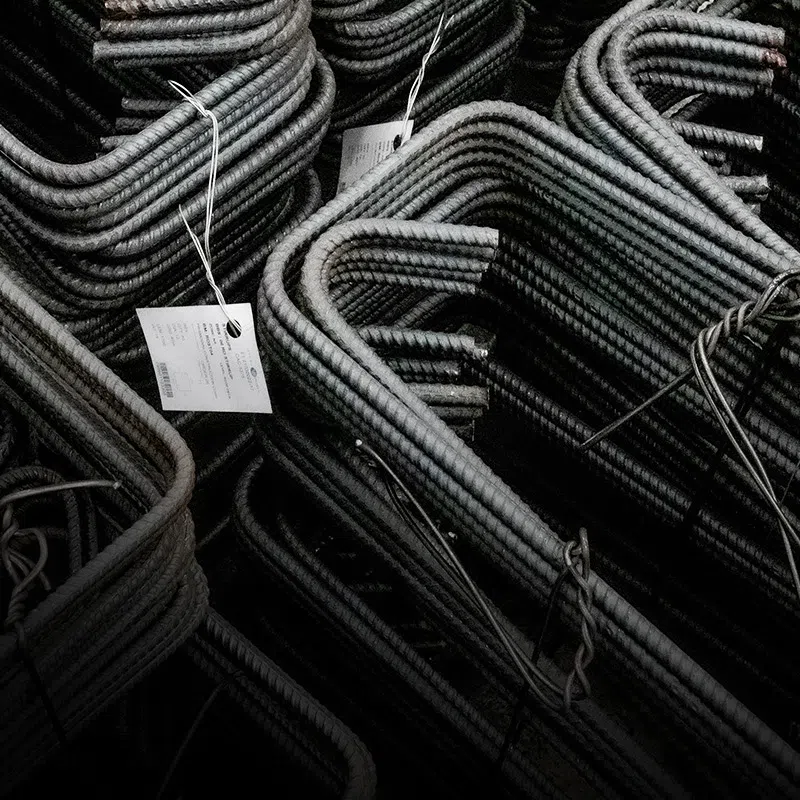

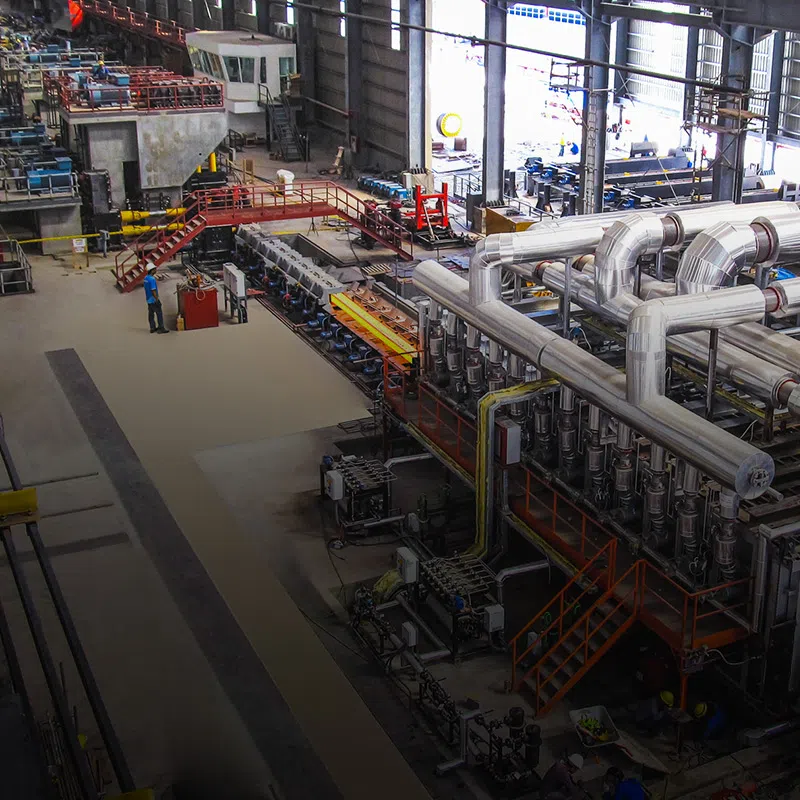

A Sustainable Steel Industry

Embedded into every steel bar that SteelAsia delivers are technological investments that reduce its environmental impact.

Our Sustainability AgendaWork with us

As SteelAsia continues to expand, we will need hardworking and talented individuals who would like to be a part of a fast-growing company with the goal of contributing to national development.

Career Opportunities